- TradFi-DeFi Report

- Posts

- Women Pioneers in Crypto

Women Pioneers in Crypto

Navigating Bitcoin and Ethereum ETFs for FAs

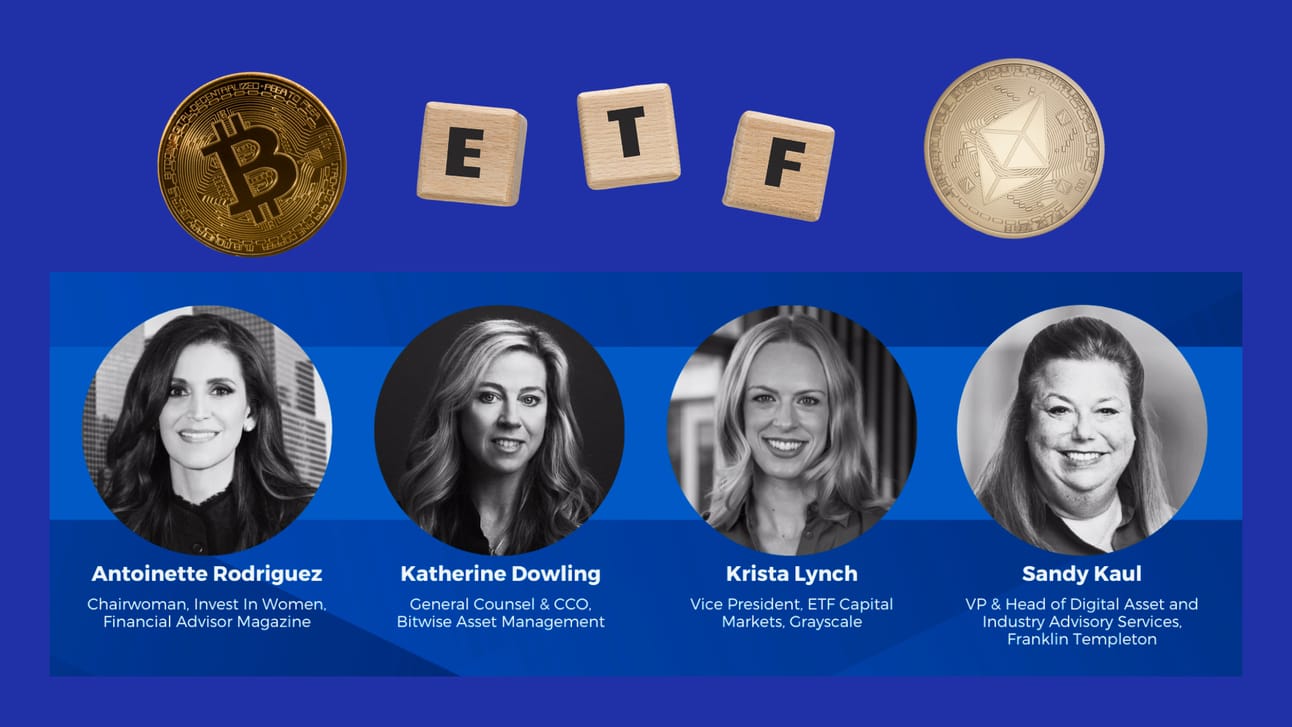

FA Magazine’s 9th Annual Invest in Women - Investing in Bitcoin Panel

As the Chairwoman of Financial Advisor Magazine's Invest in Women conferences, I had the privilege of moderating a panel at the 2024 Invest in Women event in West Palm Beach, Florida. The session, titled "Investing in Bitcoin," featured an impressive lineup of industry leaders, including Katherine Dowling, General Counsel & COO of Bitwise Asset Management; Krista Lynch, Vice President, ETF Capital Markets at Grayscale; and Sandy Kaul, VP & Head of Digital Asset and Industry Advisory Services at Franklin Templeton.

The cryptocurrency space has historically lacked representation by women. Today's debut of nine spot Ethereum ETFs marks a significant milestone, complementing the recent surge of Bitcoin ETFs and highlighting an evolving landscape that offers exciting opportunities. So the insights shared by these influential female leaders during our panel discussion are especially relevant as we embrace this new chapter in cryptocurrency investing.

Insights from the Investing in Bitcoin Panel

During our panel discussion, we explored the burgeoning interest in cryptocurrencies among investors and the unique considerations that financial advisors must keep in mind when guiding their clients through this complex asset class. Here are some key takeaways from the session:

1. Education is Crucial: Katherine Dowling emphasized the importance of educating investors about the fundamentals of cryptocurrencies and blockchain technology. She noted that a well-informed investor is better equipped to navigate the volatility and risks associated with digital assets.

2. Diversification: Krista Lynch highlighted the role of cryptocurrencies in portfolio diversification. She explained that digital assets, such as Bitcoin and Ethereum, can provide a hedge against traditional market fluctuations, offering potential for high returns.

3. Regulatory Landscape: Sandy Kaul discussed the evolving regulatory environment for cryptocurrencies. She pointed out that increased regulatory clarity could boost investor confidence and pave the way for more institutional adoption.

These insights are particularly relevant today as we witness the launch of nine spot Ethereum ETFs, a significant development in the cryptocurrency investment landscape.

Today's Launch of Nine Spot Ethereum ETFs

Today, July 23, 2024, marks a historic moment with the launch of nine spot Ethereum ETFs. These ETFs, which include the companies of our panelists, provide investors with direct exposure to Ether, the native cryptocurrency of the Ethereum blockchain, through traditional brokerage accounts. The newly launched Ethereum ETFs are:

Bitwise Ethereum ETF (NYSE: ETHW)

Franklin Templeton Ethereum ETF (CBOE: EZET)

Grayscale Ethereum Mini Trust (NYSE: ETH)

Grayscale Ethereum Trust (NYSE: ETHE)

VanEck Ethereum ETF (CBOE: ETHV)

21Shares Core Ethereum ETF (CBOE: CETH)

Invesco Galaxy Ethereum ETF (CBOE:QETH)

Fidelity Ethereum Fund (CBOE: FETH)

iShares Ethereum Trust (NASDAQ: ETHA)

These ETFs are now trading on major U.S. exchanges, including the Chicago Board Options Exchange (CBOE), Nasdaq, and NYSE Arca. The launch follows the Securities and Exchange Commission's (SEC) approval, which comes approximately six months after the introduction of spot Bitcoin ETFs in January 2024.

Implications for Wealth Managers and Financial Advisors

The launch of Ethereum ETFs presents both opportunities and challenges for wealth managers and financial advisors.

1. Client Education

You've Reached the End of the Preview.

This analysis is for premium subscribers only. Subscribe now to unlock the full report, the complete content archive, audio articles, and the strategic edge you need.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Weekly Deep-Dive Analysis: Receive our flagship 2,000+ word strategic report every week, delivered directly to your inbox.

- • Listen On-the-Go: Get an audio version of every report, perfect for your commute or workout.

- • Full Content Archive: Unlock the entire back catalog of all premium reports and audio versions.